Infrastructure Capital Finance (ICF) is an infrastructure project capital structuring and sourcing affiliate of Angelic Real Estate. ICF funds and acquires the following primary infrastructure project types, among others:

- toll roads

- toll bridges

- tunnels

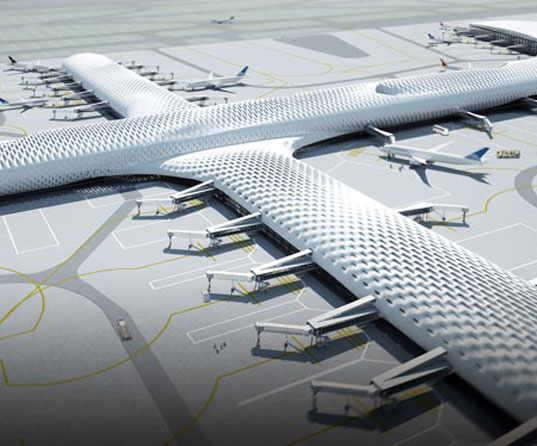

- airports

- ports

- power production installations (including solar)

- parking meterage

These projects can be new, ground-up developments or existing assets that are acquired by ICF and its partners, and generally involve long-term operating concessions, similar to long-term ground leases of property.

ICF's approach to funding such capital intensive but low-return projects is entirely unique in the realm of the public/private partnership (P3 project) model. We believe that these projects are, at their very core, a low-return but high necessity asset class, with massive capital requirements, both initially and on an ongoing basis. They are generally low-growth, long-term investments. As such, most of these projects are not truly suitable for the en vogue private equity fund realm, which seeks mid to high double digit returns on its investments.

ICF's capital structuring and sourcing provides low yield, bond-like returns, and has a substantially greater government profit sharing component to it, whereby the municipality(s) involved, and their citizenry, share significantly in the projects' success over time. Our goal is to always have such projects become net present value positive to the community, on a tangible financial level, in addition to all of the other benefits such projects provide.